In a development with significant ramifications for importers and clearing agents, the Federal Government of Nigeria has adjusted the exchange rate calculations for import duties handled by the Nigerian Customs Service (NCS).

According to The Guardian’s report, the rate has been altered from N770.88/$ to N783.174/$, signifying a policy adjustment five months after the Central Bank of Nigeria (CBN) allowed the Naira to float. This modification, evident on the NCS portal, aligns with the CBN’s decision to authorize banks to sell foreign exchange at rates determined by the market.

The shift towards a unified exchange rate system, following President Bola Tinubu’s commitment, aimed to foster stability. However, economic challenges and fiscal policy measures have led to a 70% decline in importation, resulting in higher clearing costs in Nigeria compared to other African countries.

Addressing concerns over abandoned and overdue cargoes during a recent meeting with port stakeholders, the Minister of Marine and Blue Economy, Adegboyega Oyetola, highlighted the longstanding issue of some cargoes lingering at ports for over a decade due to clearance bottlenecks.

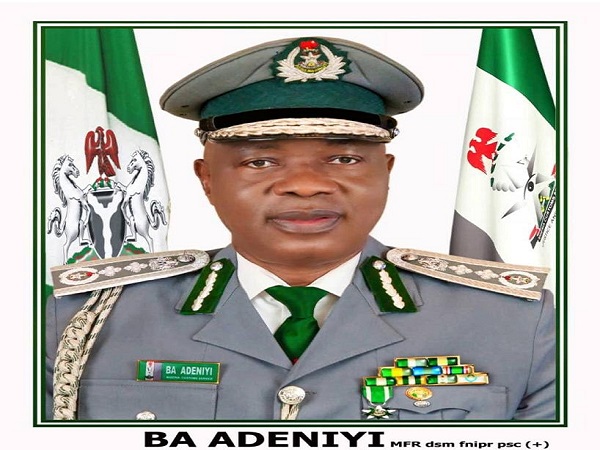

In response, the NCS has established a committee aligned with the new Customs Act that empowers it to dispose of containers exceeding their designated time within the ports. The Comptroller-General of Customs, Adewale Adeniyi, emphasized the pivotal goal of port decongestion, pledging heightened efficiency and improved trade facilitation.

Nevertheless, the adjustment in exchange rates has prompted repercussions for importers and clearing agents, necessitating an adaptation to the new rates when providing quotes for new jobs. This adjustment poses the potential for increased business costs.

The economic repercussions are already apparent, raising concerns about the potential impact on the prices of used cars and other commodities. As the government strives to enhance revenue collection, industry experts caution about heightened challenges for the masses in 2024.

The price escalation and its effect on businesses could instigate discontent, present challenges for economic stakeholders, and potentially cause disruptions across various sectors.

Analysts advocate for the government’s sensitivity to the challenging economic conditions, suggesting the consideration of palliative measures for citizens and businesses, as stringent fiscal policies may exacerbate an already delicate economic situation.

More Stories

ADC will not tolerate imposition of candidates, indiscipline – Mark

US govt takes indirect jab at Nigerian governors for spending billions on luxury houses while urging citizens to tight their belts

American plane with 179 passengers aboard catches fire during takeoff