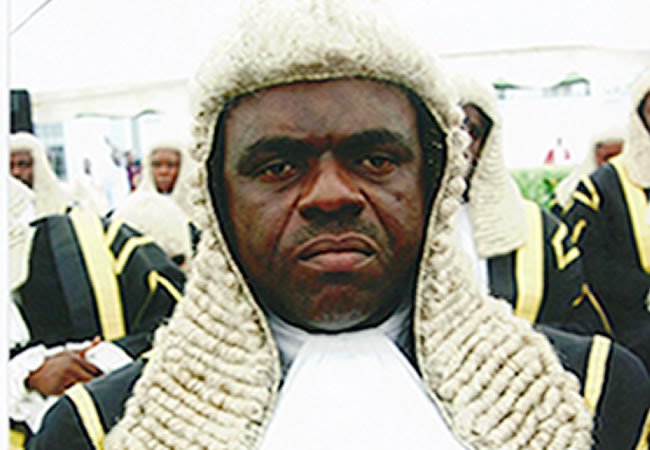

The loss of confidence from citizens on Nigeria’s justice sector has troubled the Chief Judge of the Federal High Court, Justice John Tsoho, who urged judges to reverse the trend.

Justice Tsoho made the comment on Thursday in Uyo, the Akwa Ibom State capital, while speaking at the 2023 sensitisation seminar organised by the Nigeria Deposit Insurance Corporation, (NDIC), for Federal High Court Justice.

He warned that Judges must seriously guard against delays in the dispensation of Justice which often erode trust in the system.

According to him, “It is significant to emphasise that when a bank fails, it takes a large part of the economy with it. The collapse of an institution could cause money supply to drop, leading to rise in unemployment.

“The loss of confidence in the justice sector is a recipe for anarchy. Strengthening depositors’ confidence in banks and other financial institutions through speedy dispensation of justice remains a vital part of ensuring financial stability.

“Inordinate delays culminating in a backlog of cases constitute the greatest challenge before the courts, and this easily erodes public confidence in the judiciary. Judges must seriously guard against available delays in the dispensation of Justice.

“The importance of the seminar for Judges of the Federal High Court on Deposit Money Insurance as drawn out from the theme of the seminar: ‘Strengthening depositors’ confidence in banks and other financial institutions through speedy dispensation of Justice’, cannot be over-emphasised at this time.

“On the one hand, assurances of confidence and trust are necessary to assuage growing and strident fears by depositors about internet fraud, insider dealings, and tampering with depositor’s money, mismanagement, security of such monies and items of value and other deposits in the custody of the banks and other financial institutions.”

Tsoho noted that the seminar also provided grounds for FHC Judges who are also citizens of Nigeria and who are not unaware of those problems to discuss and review the various approaches to strengthen the regulatory framework and functions of the NDIC at occasions where cases and applications were filed before them for the necessary orders and decisions to be made.

In his opening remarks, the Administrator of the National Judicial Institute (NJI), Hon Justice Salisu Abdullahi, said they could not shy away from the fact that numerous challenges were facing the banking sector, including the interplay between financial technology (fin-tech) and traditional banking.

“The questions, which require answers at this seminar, are twofold. On one hand, the question is whether the current banking laws and regulations, including the regulatory practices in institutions like NDIC, are up-to-date, relevant and in tune with the present and emerging realities.

“On the other hand, do the banking laws and regulations, including the regulatory practices in institutions like NDIC, require urgent and consequential reforms?

“These questions along with several others that are likely to be raised should necessarily form components of the discussions and outcome of this seminar for the collective good of all,” Abdullahi stated.

Welcoming the participants, the Managing Director/Chief Executive of NDIC, Hassan Bello, said: “Right from the revocation of banking licence all through liquidation and termination of liquidation activities, the judiciary plays a critical role in resolving disputes that evolves.

“Currently, the maximum claim for depositors of Deposit Money Banks, (DMBs), Primary Mortgage Banks(PMBs), Payment Service Banks(PSBs), and subscribers of Mobile Money Operators (MMOs) is N500,0000 per depositor-per deposit taking institution-while Micro-Finance Banks(MFB) have a maximum coverage limit of N200, 000 per depositor per MFB.”

More Stories

ADC will not tolerate imposition of candidates, indiscipline – Mark

US govt takes indirect jab at Nigerian governors for spending billions on luxury houses while urging citizens to tight their belts

American plane with 179 passengers aboard catches fire during takeoff