By Blossom Chukwu

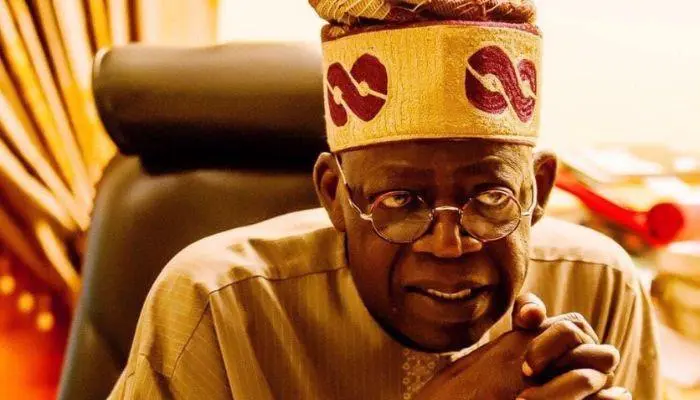

As the Bola Tinubu era begins, there is one sector that the whole economy seems to be clinging onto, for sustainable execution of goals and objectives and worthwhile national development, it is the Oil and Gas sector. This is why Oil and Gas companies operating in the country, recently tasked the Tinubu Administration with the need to end ongoing oil theft and pipeline vandalism, that has continued to suppress production in the oil-rich Niger Delta region.

This also explains why the Buhari government gave all the required support to the Dangote Petroleum Refinery, that has been successfully inaugurated, after over six years in the making. This support for Dangote came since the government owned Nigerian National Petroleum Corporation, NNPC, are still having great challenges organising themselves for better results and dealing with the issues they have as a business organisation. This is why the whole nation had to literarily wait on one man, talking about Aliko Dangote, to deliver the people’s expectations, that the government they have been waiting on, were still having issues with.

As the entire country heaved a sigh of relief that the Dangote Refinery has finally been set on the production run, the Governor of Central Bank of Nigeria, CBN, Godwin Emefiele like a satisfied investor said, the newly inaugurated Dangote Refinery will positively impact the Nigerian economy, and help the country generate 12,000 more Megawatts of electricity. Among some of the other benefits listed to the Nigerian economy, the CBN governor also stated that over 135,000 permanent jobs will be available to Nigerians as operations get underway.

According to him, it is also expected that the Refinery saves Nigeria between $25 and $30 billion in forex annually. Emefiele noted that, like a venture that continues to give, the Refinery will further give the economy an inflow of $10billion yearly. He described the Dangote Refinery as an indication that Nigeria can produce whatever it needs.

The facility, located at Dangote Industries Free Zone, Ibeju-Lekki, Lagos, is expected to process crude oil grades from the continent of Africa, Asia and America, with a delivery of a surplus of close to 38 million litres of Petrol, Diesel, Kerosene and Aviation fuel for Nigeria daily. The Refinery is also expected to refine 650,000 barrels of crude oil per day and transform crude oil into different usage of petroleum products. It will also produce Euro-V quality Gasoline and Diesel, as well as Jet fuel and Polypropylene.

Emefiele gave this assurance while speaking at the commissioning of the Dangote Refinery in Lagos on Monday, May 22. Meanwhile, speaking at the CEOs panel at the Nigeria International Energy Summit in Abuja, that held between April 16 to 20, it was observed that constant attacks on pipelines have reduced Oil and Gas supply to just 60 per cent capacity in the past few years.

While the Petroleum Industry Act (PIA) has done a great job, there are many areas that remain to be dealt with across the country. For instance, how do you make the Gas-to-Power sector work? Experts suggest that however we want to discuss energy for Nigerians in Nigeria, if we don’t fix the energy value chain, even if 10 PIAs are passed, and all other acts in the world, it will not solve the problem.

This is why priorities given to these issues by the Tinubu government would determine “the success or failure of whatever energy policy that the country will have, going forward”. This is also as oil theft has greatly impacted oil production and export. This is why it is an urgent call on the Tinubu government, to fully address the issue as it takes over the reins of national leadership.

Still in setting an agenda for the Tinubu government in the Oil and Gas sector, the Chairman of Shell Companies in Nigeria, Mr Osagie Okunbor disclosed that the outgoing government still owed the company $200 million for Gas supplied to the Power sector. While calling for the implementation of laws and policies governing the sector, he noted that the country is not short of frameworks and written documentation.

According to him, “We think of this in terms of meeting up with our OPEC quota but an equally devastating implication is that we cannot supply the gas required to Nigeria LNG. So, if you ask me what the number issue for the incoming administration is, it has to be the security of our oil and gas infrastructure. I think it is so existential to us that if we don’t fix it, we have a huge problem on our hands”, he added.

This has made Oil production in the country to fail to meet the quota set by OPEC in the past two years, negatively impacting on the nation’s revenue and the operations of companies.

Meanwhile, with regards to the removal of Petroleum Subsidy, in the 2023 federal budget, it is proposed that Petrol Subsidy will remain up to mid-2023 based on the 18-month extension announced in early 2022. In this regard, only N3.36tn was provided for the PMS subsidy. If consumption and subsidy is sustained until the end of the year 2023, it will imply a subsidy figure of not less than N6.72tn.

The Nigeria Extractive Industries Transparency Initiative reports that N13.7tn has been spent on fuel subsidy in the last 15 years. There are a plethora of reasons justifying fuel subsidy removal. These include Nigeria’s unsustainable fiscal position as evidenced in the huge debt profile, perennial fiscal deficits and poor macro-economic indicators. The subsidy is currently being funded from borrowing.

Though removing Fuel Subsidy in this sense will lead to the eradication of the massive corruption in the sector, to achieve this, it is recommended that the Federal Government engages organised labour, private sector and the public in good faith negotiations with relevant information, and design a social intervention programme to cushion the hardship in critical sectors like transport, agriculture and food.

It should also take steps to conclude the revitalisation of existing Refineries and thereafter run them efficiently. In the alternative, there should be the concession or privatisation of the Refineries, after the repairs and turnaround maintenance. The proposed private sector participation should be done under a process that is transparent, guarantees value for money and ensures that the firm has technical, financial and managerial capacity to run the Refineries. The Federal Government should also grant more licences to firms, to engage in local oil refining to avoid creating undue monopoly with the likes of Dangote Refinery that has come on board.

In containing Oil Theft, NEITI disclosed in a December 2022 statement that about 619.7 million barrels of crude oil, valued at $46.16bn or N16.25tn, have been stolen in the last 12 years. This averages N1.354tn annually. According to data from the Nigerian Upstream Petroleum Regulatory Commission, Nigeria’s crude oil production dropped to 998,602 barrels per day in April 2023, from its March 2023 1.2mbpd. Although there are other reasons that may have reduced oil production, this may be evidence that Oil theft may have escalated beyond comprehension. This is against the background of the 2023 budget projection of 1.69million bpd.

The recommendations to reduce Oil theft and vandalisation to a minimum, should be by holding accountable officers under whose watch industrial-scale oil theft occurs. It also considers a certification and authentication system – pipeline integrity programme that traces Nigerian crude from the wells to Refineries as a means of eradicating Oil theft. Furthermore, activate the real-time online monitoring of pipelines and strategic Oil and Gas resources paid for, in federal budgets between 2010–2014 and in recent years. If this facility is not available, then hold to account individuals and institutions that drew down the appropriated votes without delivering any value.

Nigeria has been struggling to meet its Organisation of the Petroleum Exporting Countries, OPEC, quota and budget benchmark for some years. Nigeria did not meet the 1.8mbpd benchmark of the 2022 federal budget and has not been able to meet the 2023 federal budget benchmark of 1.69mbpd so far. Nigeria’s current reserves stand at 36.9 billion barrels and the reserves are declining due to low exploration activities.

Beyond Oil Theft, Investments in the sector from oil majors have decreased over the years, as many of them have been divesting and selling off their assets to local investors. Nigeria’s total annual upstream capital expenditure decreased by 74 per cent from $27bn in 2014 to less than $6bn in 2022. This is as Oil is a timebound energy source whose value will continue to diminish over time in the global march to carbon reduction.

This is why it is recommended that Nigeria should maximise Investments to improve Oil reserves and oil production and target not less than three million bpd in the medium term. NNPC Limited should drive fundraising for investments in the sector. Its preparation for an initial public offer should be accelerated. The management of NNPC Limited and other relevant agencies should be revamped to attract world/best in class managers to drive reforms in the sector. Furthermore, the full implementation of the relevant sections of the PIA should be guaranteed.

Nigeria’s associated gas reserves is 102.32 trillion cubic feet, non-associated gas reserves stand at 106.51 trillion cubic feet, making the total of 208.83 trillion cubic feet of natural gas reserves. Again, this is an energy source that is time bound in the global march to carbon reduction. Nigerian needs to maximise investments in gas gathering processing, local use as well as export. There are gas fiscal incentives under the PIA – a maximum of 10-year gas tax holiday and benefits under S.39 of the Companies Income Tax Act, and investors in gas pipeline will be granted an additional tax-free period of five years at the expiration of the tax-free period granted in S.39 of the Companies Income Tax Act and S.302 (6) of the PIA. The Nigerian Morocco Gas Pipeline and other projects should be implemented for increased earnings from Gas.

Nigeria’s large diaspora community is an asset waiting to be tapped into as a source of investments for these and other projects. The bulk of the remittances so far is for welfare and to support families back home, which is distinct from capital investments. Investments from Nigerians in Nigeria and in the Diaspora will, definitely raise some of the needed resources. This is as utmost transparency and accountability is guaranteed.

These are some of the agenda that professionals in the Oil and Gas sector have set for the Tinubu Administration. In other words, there is no time to waste, every time is key in helping revitalise the Nigerian Oil and Gas sector that had been previously weakened. Nigerians are also waiting to tap into every resource that this sector brings on board, as the Tinubu government starts full governance without any undue delay.

More Stories

Fashola weighs in on Lagos streets renaming, says state’s history must be preserved

Don’t put Nigeria at risk of expanded U.S. visa ban, Customs warns Nigerian travellers

U.S. raises bounty for wanted Venezuelan president, Nicolas Maduro, to $25m over alleged narcotics trafficking